Short Swing Profit Rule

It is part of united states federal securities law and is a prophylactic measure intended to guard against so called insider trading.

Short swing profit rule. Short swing profit rules under the exchange act. Section 16 b provides that specified corporate insiders must surrender any. Section 16 insider reporting and liability for short swing trading a public company with a class of securities registered under section 12 or which is subject to section 15 d of the securities exchange act of 1934 as amended exchange act must file reports with the sec reporting requirements. Officers directors and 10 holders are considered insiders for purposes of section 16.

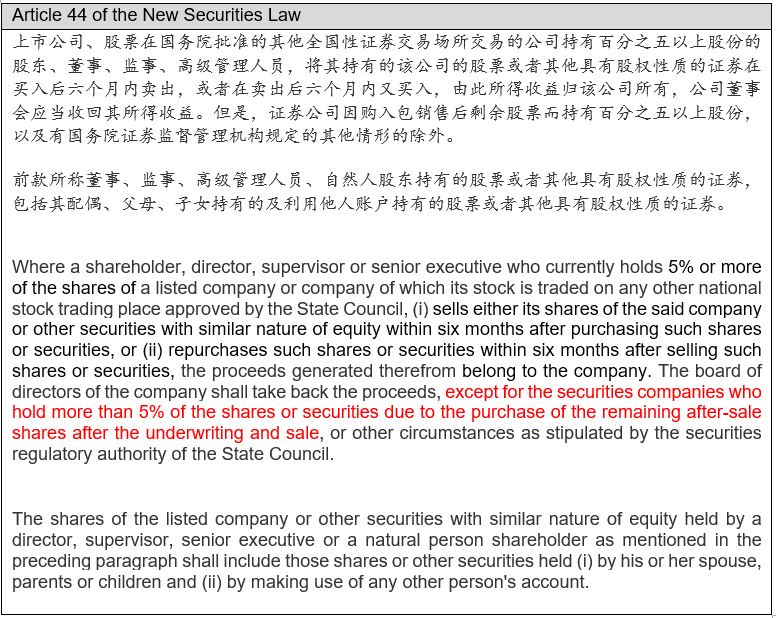

The short swing profit rule also known as the section 16b rule is an sec regulation that prevents insiders in a publicly traded company from reaping short term profits. Posted by brenda hamilton securities and going public lawyer. Final section 16 reporting and short swing profit rules. The company cannot waive its right to recover the short swing profits and any stockholder of the company can bring suit in the name of the company to recover short swing profits on behalf of the company.

Public company from profiting from any purchase or sale or sale and purchase of the company s equity securities within a period of less than six months. What do the short swing profit rules of section 16 prohibit. Final section 16 rules are user friendly. Section 16 prohibits short swing transactions.

Short swing transactions are the sale and purchase of a public company s. Section 16 imposes a strict liability standard good faith mistakes or misunderstandings of the law are not defenses. The so called short swing profit rule under securities exchange act section 16 b generally prohibits officers and directors as well as 10 percent shareholders of a u s. In broad strokes the short swing profits rule provides that any profit realized by insiders of an issuer from the purchase and sale or any sale and purchase of any equity security of the issuer.

A short swing rule restricts officers and insiders of a company from making short term profits at the expense of the firm. The short swing profit rules were created to prevent insiders who have greater access to material company information from taking advantage of information for the purpose of making short term profits from trading an issuer s securities.